Housing Eligibility Map Rural Development

Table of Content

The higher the interest rate on your mortgage, the more money you’ll pay over the duration of the loan. As such, you should try to find as low an interest rate as possible. Copyright 2022 My Florida Regional MLS DBA Stellar MLS, All rights reserved.

To assess potential eligibility of an applicant/household, click on one of the Single Family Housing Program links above and then select the applicable link. Applications for this program are accepted through your local RD office year round. As with any other mortgage, you will be required to obtain an appraisal for your new home. The difference is that the appraiser must also state that the condition of the home meets USDA standards. If any of the above mirrors your situation or finances, a USDA loan might be the perfect option for you and your family.

Housing Eligibility Map

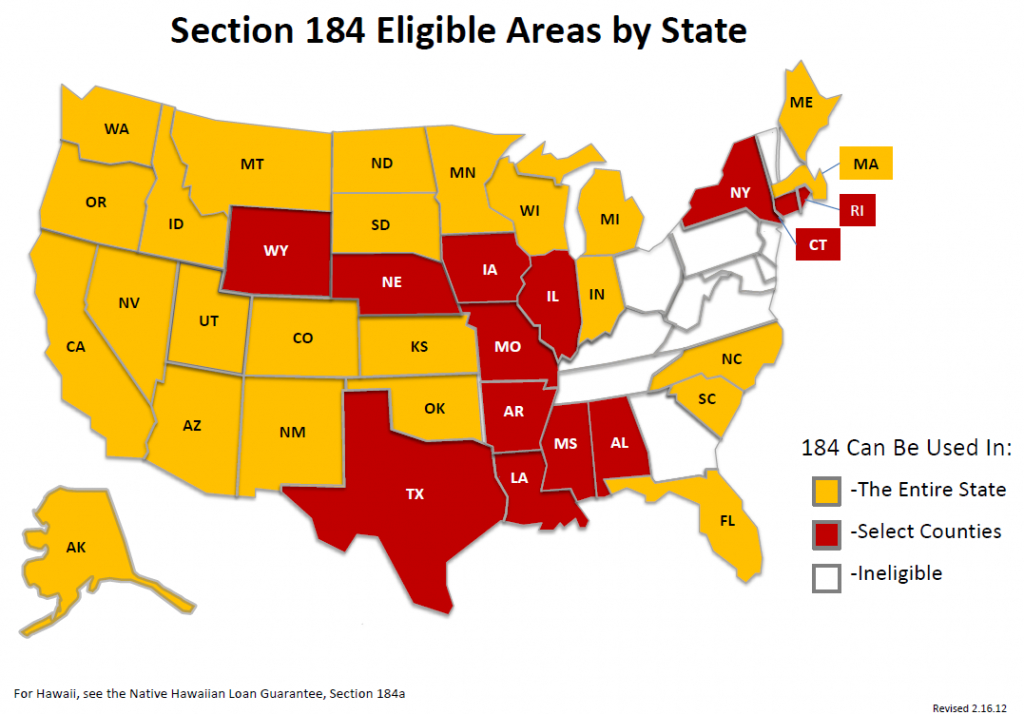

USDA offers financing with no down payment, reduced mortgage insurance, and below-market mortgage rates. To determine if a property is located in an eligible rural area, click on one of the USDA Loan program links above and then select the Property Eligibility Program link. When you select a Rural Development program, you will be directed to the appropriate property eligibility screen for the Rural Development loan program you selected.

USDA rates are typically only matched by the VA loan, which is exclusively for veterans and service members. These two programs can offer below-market interest rates because their government guarantee protects lenders against loss. To find out if the property you’re buying is in a USDA-eligible area, and whether or not you meet local income limits, you can use the USDA’s eligibility maps. Business opportunity projects are used to identify and analyze business opportunities that will use local rural materials or human resources. These projects must be consistent with local and area-wide community and economic development strategic plans.

Grace Bay City Texas 77414

Instead, private lenders are authorized to offer USDA loans. That means you can get a USDA mortgage from many mainstream banks, mortgage lenders, and credit unions. USDA loan eligibility requirements are based on the buyer and the property. First, the home must be in an eligible rural area, which USDA typically defines as a population of less than 20,000. Beyond that, the USDA sweetens the deal by offering their loans with a $0 down payment from you. Direct loans come with low interest rates — three percent, as of December 2019.

Unfortunately, when you get a USDA loan, you must pay mortgage insurance for the entirety of the loan. Again, this enables you to buy a house without having any savings on hand. You can just add the extra $3,000 to $6,000 in closing costs onto your loan and pay it off over time or ask the seller to contribute up to 6% seller concessions. These datasets are referenced in the scoring of applications requesting grant funds as part of the funding type request.

What You Need to Know about USDA Loan Requirements

USDA eligibility standards are lenient in comparison to traditional mortgage loans. Aside from the income and geographic requirements, USDA approval is very generous and accommodating for modern financial and household situations. While other mortgage loans require applicants to meet a certain income, USDA sets maximum income limits. The USDA program helps lower and moderate income U.S. citizens achieve homeownership in rural areas.

Additionally, officials will exclude any income from an earned income tax credit. USDA home loans don’t impose limits on what type of home you can buy. As long as you qualify, you can buy any home within an approved region. Home buyers who qualify for USDA may be able to get a deal right now.

Note, though, that these restrictions might not be as tight as you think. A USDA loan doesn’t require you to live out in the middle of nowhere. In fact, most areas of the country meet the criteria for a USDA loan.

About 97 percent of the United States landmass fits the USDA loan’s definition of rural. Only 3 percent is ineligible at the time of writing this article. Beyond that, the USDA loan isn’t all that different from other mortgage programs. The repayment schedule doesn’t feature a “balloon” or anything non-standard, the closing costs are ordinary, and prepayment penalties never apply.

These loans are specifically geared to rural areas or the suburbs and can’t be used in city limits usually. With any home purchased comes thousands of dollars worth of miscellaneous closing costs. In normal circumstances, these closing costs need to be paid in full before the transaction is finished. When you have a USDA loan, however, you can roll these closing costs into your loan. Another benefit of USDA loans is that they allow for low credit scores. Generally speaking, you can get a USDA loan with a credit score as low as 640.

And with just this background information in mind, you can probably guess some of the stipulations that come with a USDA loan. Oftentimes, they require repairs, extensive and otherwise. Unfortunately, not all mortgages are designed to pay for these repairs.

Comments

Post a Comment